PolicyX.com Reports Strong FY25 Performance Driven by Digital Expansion and AI-Led Customer Experience

PolicyX delivers strong FY25 results with 54% income growth, stable profitability, higher assets, and accelerated AI-led digital and advisory expansion.

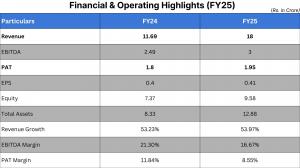

GURUGRAM, HARYANA, INDIA, December 22, 2025 /EINPresswire.com/ -- PolicyX.com, one of India’s leading insurance comparison and advisory platforms, announced a robust financial and operational performance for FY25, supported by strong digital adoption, expanding customer demand across product categories, and continued investments in technology and AI-driven advisory tools.Financial & Operating Highlights (FY25)

● Revenue from Operations rose to ₹15.69 crore in FY25, compared to ₹11.57 crore in FY24, reflecting a 35.6% year-on-year growth. The company’s Total Income increased to ₹18.20 crore, up from ₹11.69 crore in the previous year, marking a 53.97% growth driven by steady expansion across insurance product segments and improved operating efficiencies.

● Profitability remained stable, with Profit Before Tax (PBT) rising to ₹2.46 crore, a 7.0% YoY increase, while Profit After Tax (PAT) stood at ₹1.8 crore, up 7.2% YoY. Earnings Per Share (EPS) remained steady at ₹0.40, reflecting consistent performance.

● The company’s financial position strengthened further, with Total Assets increasing to ₹12.89 crore, a 54.70% growth over FY24, underscoring improved liquidity and continued investments in technology and operational infrastructure.

● A notable highlight for the year was the sharp rise in Work-in-Progress (Unbilled Revenue), signalling a strong and expanding order pipeline heading into FY26.

● These results reaffirm PolicyX.com’s operational resilience, customer-focused digital model, and ongoing commitment to innovation in India’s insurance distribution ecosystem.

Cost Structure & Investments

● Employee Expenses: 51% increase YoY to ₹8.66 crore, reflecting strategic expansion in tech, operations & customer service teams PX FY25.

● Marketing Expenses: Increased to ₹5.09 crore (↑49% YoY) to drive deeper market penetration & brand visibility PX FY25.

● Technology Capex: Asset base grew 21%, highlighting continued investments in platforms, servers & digital infrastructure.

Digital & Technology Highlights (FY25)

PolicyX accelerated its digital-first roadmap with key innovations:

AI-Led Advisory Tools

● New AI-driven recommendation engine shortened decision-making time for customers.

● Enhanced need-based comparison logic improved plan suitability across health, motor & term segments.

Chatbot Automation

● Over 40% of customer queries routed through automated chat workflows, reducing support load and turnaround time.

Claims Assistance Technology

● Predictive models introduced for PED rules, room rent limits, IDV optimisation, and documentation tracking.

● Improved customer clarity boosted satisfaction scores and reduced post-sale friction.

Regional Language Support

● Expanded multilingual advisory to 8 languages, strengthening penetration in Tier 2–3 geographies.

Business Segment Performance (FY25)

Health Insurance

● Strong growth led by rising demand for higher coverage & OPD add-ons.

● Digital comparison & claims advisory tools improved conversion rates.

Life & Term Insurance

● Increased adoption of need-based calculators drove higher term policy uptake.

● Younger demographic (25–40) became the fastest-growing cohort.

Motor Insurance

● PolicyX’s IDV optimisation helped customers reduce premium leakage.

● Renewals strengthened due to simplified reminder & comparison workflows.

Management Commentary

Naval Goel, Founder & CEO, PolicyX.com, said FY25 reflects our strongest year of consolidated digital performance. We have scaled sustainably strengthening revenue, investing in people, upgrading our technology stack, and expanding our advisory capabilities. This positions us well for accelerated growth in FY26.

He added “Insurance awareness in India is rising rapidly, and our goal is to simplify every stage of the customer journey from comparison to claims. FY26 will see deeper AI integration, multilingual expansion, and improved post-policy engagement workflows.”

Strategic Priorities for FY26

● Scaling AI-driven underwriting & comparison engines

● Expanding into Tier 2–4 markets with regional language support

● Launching real-time claims assistance dashboards

● Strengthening partnerships with life, health & motor insurers

● Deepening customer lifecycle engagement through automation

About PolicyX.com

PolicyX.com is one of India’s most trusted insurance comparison and advisory platforms, partnering with 50+ insurers across categories including health, motor, term, investment, and corporate insurance. With advanced AI-led tools, multilingual support, and customer-first design, the platform is transforming digital insurance distribution in India.

Naval Goel

PolicyX.com

+91 99712 66338

naval.goel@policyx.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.